What began as a TikTok trend promising “free money” from Chase Bank ATMs has spiraled into one of the most striking examples of how viral misinformation can collide with financial crime. As federal investigators trace digital breadcrumbs, ordinary users who believed they’d found a loophole now face lawsuits and potential felony charges.

A Viral Illusion of “Free Money”

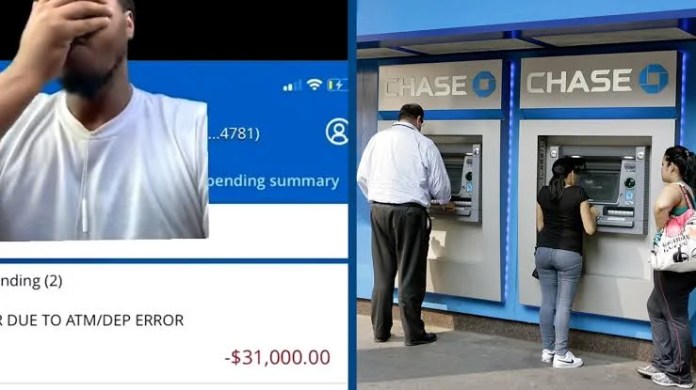

The phenomenon took root much like many other internet trends — it started with a video, whispered rumors, and an irresistible promise. Social media platforms like TikTok and Instagram became hotbeds of activity as users shared videos claiming to have discovered a “glitch” in Chase Bank ATMs. This glitch supposedly allowed anyone to withdraw funds far exceeding their account balance. Dubbed the “infinite money glitch,” these videos showcased participants depositing faux checks and swiftly withdrawing generous sums of cash, creating an allure that was difficult to resist.

However, this much-coveted glitch was nothing more than an illusion. The reality involved participants exploiting a check-processing delay — they deposited counterfeit or non-existent checks and withdrew the funds before the bank’s systems could confirm their authenticity. When the inevitable happened, and the checks bounced, the bank was left with substantial losses, while those caught up in the trend were left with a digital fingerprint of their fraudulent activities.

“There is no such thing as free money,” one investigator succinctly stated, capturing the harsh lesson learned by numerous enthusiastic users who joined in believing they had discovered a financial shortcut.

The Mechanics of a Viral Crime

The mechanism behind this scheme was deceptively simple, yet its impact was profound. Participants deposited counterfeit checks, sometimes worth hundreds of thousands of dollars, into Chase ATMs. Banks typically grant limited access to deposited funds before they clear completely, allowing scammers to withdraw sizable amounts in the interim period.

Take a startling instance from Houston: one individual reportedly deposited a fake check for $335,000 and managed to withdraw a large portion within just 48 hours before the scam was detected. By the time Chase froze his account, he owed nearly $291,000. This quick cash flow lured many into what they thought was a harmless financial adventure, but the consequences were far from benign.

In response, JPMorgan Chase confirmed they had filed multiple lawsuits in cities such as Los Angeles, Houston, and Miami, targeting individuals and businesses accused of collectively absconding with more than $661,000. A spokesperson for the bank affirmed they acted promptly to warn customers and initiate legal action the moment the scam became apparent through social media channels.

From Hoax to Federal Investigation

According to the Financial Crimes Enforcement Network (FinCEN), incidents of check fraud have surged throughout the United States, marking it as “the largest source of illicit proceeds in the country.” While most past cases revolved around mail theft or delivery fraud, new, digitally-savvy variants — like this ATM glitch — are proliferating rapidly. FinCEN has warned that the viral nature of the internet has accelerated engagement in such fraudulent activities.

“Because the glitch went viral online, more people likely participated than usual, being influenced by the prospect of easy money,” noted FinCEN analysts.

This practice, legally known as check kiting, capitalizes on temporal lags in bank processing to provide access to nonexistent funds. Legal categorization varies, but it commonly falls under the umbrella of check fraud, which can be pursued as either a misdemeanor or felony, depending on the monetary amount involved. In most jurisdictions, defrauding an institution of over $500 constitutes a felony charge, potentially leading to severe repercussions for those caught.

The New Face of Old Fraud

While traditional checkbooks may seem outdated, check fraud has experienced a notable resurgence in the digital landscape. Chase officials recognize that despite a decline in check usage, fraudsters are adeptly exploiting outdated financial structures — merging old-school methods with the rapid spread of contemporary digital currents.

In a statement, the bank remarked, “This kind of check fraud was really just a viral hoax and a crime.” What many participants viewed as a harmless trick of the internet has now evolved into a cautionary narrative about the dangers of digital groupthink and the rapid dissemination of misinformation. This situation highlights the necessity for stringent awareness and education regarding financial activities in an age where lines between reality and viral illusions can easily blur.